A snapshot of the Greek economy

Following January’s five-year bond issuance, which raised 2.5 billion, along with Moody’s upgrading the country’s sovereign credit rating to B3 from B1 and Fitch’s confirming its own rating at BB-, last Tuesday Greece issued its first 10-year bond since the country entered the debt crisis nine years ago.

The issuance was undoubtedly a success, and raised another 2.5 billion, while the offers from the 419 investors (over 50 percent more than those who participated in the five-year bond issue) exceeded a total of 11.8 billion, driving down the interest rate to 3.9 percent from the initial 4.125 percent guidance, with a coupon setting at 3.875 percent. The previous one dates to March 2010, nine years ago, when the yield reached its peak at 6.25 percent. Therefore, this issuance can be interpreted as the first true sign of the Greek economy returning to form.

The above, along with the Ministry of Finance’s recent predictions about this year’s performance, provide a great opportunity to examine state of the Greek economy at this early point of the year

Budget balance: According to the Ministry of Finance, the Greek government budget achieved a primary surplus of 729 million for January, against a primary deficit target of 103 million. During the same period last year, the budget recorded a primary surplus of 1.797 billion. In addition, the government budget balance showed a deficit of 442 million against a target of 1.183 billion, initially foreseen in the introductory report for the budget of 2019 for January.

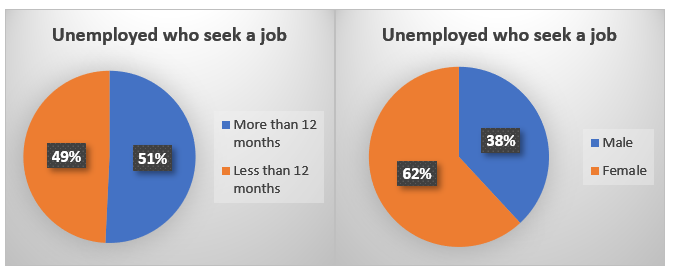

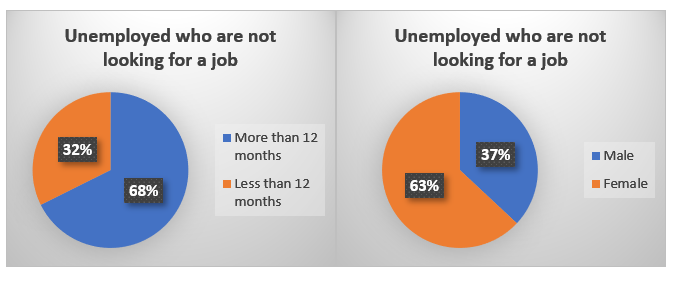

Unemployment: We distinguish between two categories. Unemployed who are seeking jobs and the rest. For January 2019, the first category recorded 957,532 people, which was 22,083 or 2.36 percent more than those recorded during the previous month (935,449) and 54,229 or 6 percent more than those recording the same period last year (January 2018). Of those, 50.76percent have been seeking a job for more than 12 months, while the vast majority is female (61.9percent). We must note however, that there is a large group (about 120,000) that are seasonally unemployed and come from the agricultural and tourism sectors.

Source: OAED

In contrast, those who are not look for a job came to 11,810 or 6.51 percent less than those in December 2018, and 19,465 or 10.3 percent less than those in January 2018. From this group, those who have been unemployed for more than 12 months account for 32.37 percent, with the majority again being female at 63.04 percent.

Source: OAED

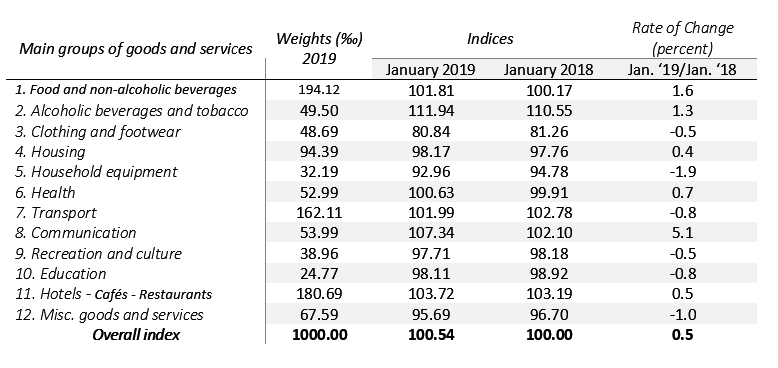

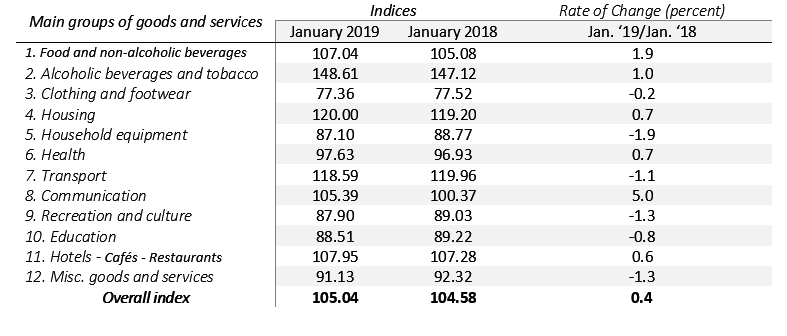

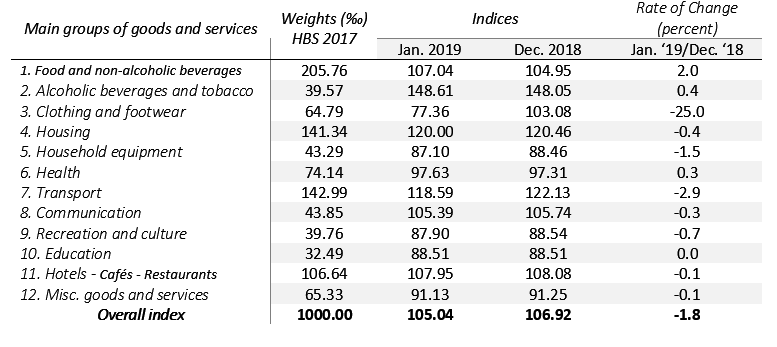

Inflation: Eurostat announced that the inflation rate (Harmonised Index of Consumer Prices[1]) came to 0.5 percent (annual basis) compared to 0.6 percent in December 2018 and 0.2percent January 2018. This is the lowest in the eurozone.

The Hellenic Statistical Authority’s (ELSTAT) reported increase in the overall CPI (national Consumer Price Index) is slightly lower at 0.4 percent. The increase is mainly due the 5percent rise in communication, largely attributed to the prices of telephone services. Also, there was a 1.9 percent increase in food and non-alcoholic beverages mainly due to the increase in prices of bread and cereals, milk cheese and eggs, poultry, fresh vegetables, potatoes, fruit juices. The increase, however, was partially offset by the decrease in the prices of pork, olive oil, dried salted or smoked meat, preserved or processed vegetables. On the other hand, main decreases occurred in household equipment mainly because of the decrease in prices of textiles, household appliances and repair, and other non-durable goods.

Finally, the CPI decreased by 1.8 percent in January 2019, largely due to winter sales, which drove a 25 percent decrease in clothing and footwear prices as well as a 1.5 percent decrease in household equipment. In addition, there was a 2.9 percent decrease in transport services, mainly due to decreases in the prices of fuels, lubricants and passenger tickets for air transport.

Bank Credit and Deposits: In January 2019, the annual growth rate of total credit extended to the economy stood at -1.4 percent from -1.3 percent in the previous month and the monthly net flow was negative at 1.530 million, compared with a positive net flow of 1.743 million in the previous month. The annual growth rate of total deposits stood at 8.0 percent from 10.4 percent in the previous month and the monthly net flow was negative at 1.788 million, compared with a positive net flow of 4.752 million in December 2018.

The monthly net flow of credit to the general government was negative at 825 million, compared with a positive net flow of 875 million in the previous month. The annual growth rate of credit to the general government set at -3.4 percent from -2.0 percent in the previous month, whereas the annual growth rate of credit to the private sector remained unchanged to -1.1 percent, from the previous month. The monthly net flow of credit to the private sector was negative at 705 million, compared with a positive net flow of 868 million in the previous month.

On the deposits side, the general government decreased its placements by 241 million, compared with an increase of 1.601 million in the previous month and the annual growth rate settled at 23.2 percent from 56.3 percent in December 2018. The private sector’s placements were also decreased by 1,547 million, compared with an increase of 3.151 million in the previous month and the annual growth rate set at 6.2 percent from 6.3 percent in December.

To sum up, the 10-year bond issuance was indeed a clear vote of confidence in the Greek economy. Moreover, 2018, was a year during which Greece broke all performance records to date in tourism, welcoming more than 33 million travellers, generating more than 16 billion euros. The rise of tourism along with the blooming of Airbnb and similar platforms, and the golden visa program have led to a sharp increase in foreign demand for, and investment in property, especially holiday homes. Tourism, however, was not the only record-breaking sector in Greece for 2018. Exports generated 33.02 billion, an increase of 15.8 percent compared to 2017, hitting a historic high.

Although, all of these are proof that the economy is getting back on track, Greece has not yet fully recovered. ELSTAT announced that the economy grew at a rate of 1.9 percent in 2018, compared with the target rate of 2.1 percent and the target for this year is set at 2.5 percent. The European Commission warned (again) that the Greek economic recovery is “heavily contingent” on continued reforms.

Privatisations of key industries are stalled and major investments like the ones involving the abandoned airport at Hellenikon and the port of Piraeus are being hampered. Yet most importantly, no agreement has been reached about the non-performing loans, posing a serious threat for the banking system.

In a declining economic climate in the eurozone and during an extended pre-election period, it is questionable whether the country will be able to meet its targets. If the government wants to succeed, it will have to engage in and speed up the reforms, diversify away from debt-fuelled consumption, promote high value-added sectors and transform the public sector to be more effective and citizen-friendly.

*Dimitris is a PhD candidate in Economics at the Athens University of Economics and Business. His research focuses primarily on Econometrics and its applications on Economic Growth and Finance.

[1] The Harmonised Index of Consumer Prices (HICP) is an indicator of inflation and price stability for the European Central Bank (ECB). It measures the change over time in the prices of consumer goods and services acquired, used or paid for by euro area households. The term “harmonised” denotes the fact that all the countries in the European Union follow the same methodology. This ensures that the data for one country can be compared with the data for another. The HICP is also used as a criterion whether a country is ready to join the euro area.

Podcast - Whose property? Greece’s housing challenges

Podcast - Whose property? Greece’s housing challenges Can the Green Transition be just?

Can the Green Transition be just? Where is Greek growth coming from?

Where is Greek growth coming from? Bravo, Bank of Greece

Bravo, Bank of Greece