Eurogroup confirms tighter fiscal environment in coming years

The Eurogroup this week re-affirmed the fiscal guidance for 2024 that was published by the European Commission earlier in the month. The eurozone is planning to return to fiscal normality, as the escape clause that was activated during the pandemic comes to an end and the continent appears to have weathered the energy adversities that stem from the conflict in Ukraine.

In the statement that followed the meeting of eurozone finance ministers this week it is noted that over 2023-24, fiscal policies should remain prudent and aim to ensure medium-term debt sustainability.

At the same time, the growth potential should be boosted in a sustainable manner and in line with the green and digital agendas via investment and reforms.

Eurozone finance ministers agreed that the broad-based approach to stimulate aggregate demand via support packages is not warranted any longer and as such there will be close monitoring of the extension of current support measures, while permanent deficit-rising measures should be avoided.

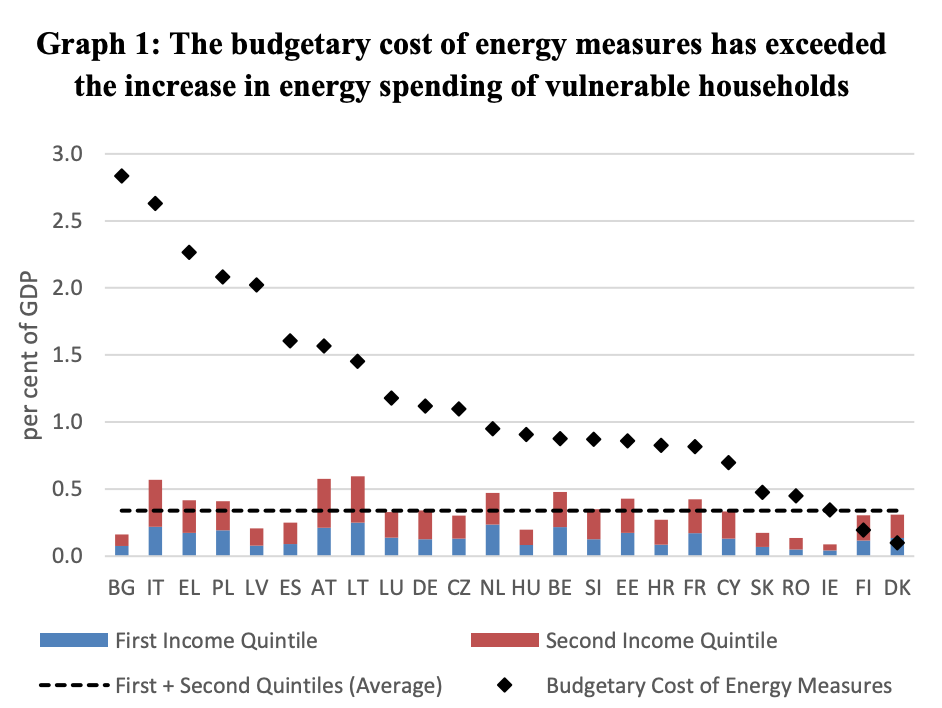

This is in line with the data that was presented in the fiscal guidance of the European Commission, where it was presented that in 2022 the measures to support energy costs were 1.2 pct of the EU GDP, while certain countries were a complete outlier with much more generous support packages.

The Commission notes that more than 70 pct of the energy support was not targeted to the most vulnerable households, while the fiscal cost of the Greek package was nearing 2.5 pct, double the EU average and third across the EU, only behind Bulgaria and Italy.

As Europe finds its footing after the shock of the pandemic and the impact of the conflict in Ukraine that mostly manifested in the energy markets and the passthrough to inflation, the fiscal landscape becomes clearer for the Greek authorities.

Greece maximised the flexibility that was offered over the last few years and extended some 50 billion euros in pandemic and energy support. However, the legacy commitments of its debt crisis are soon catching up in defining fiscal policy over the coming years and decades.

Greece is already expected to turn to a primary surplus of 0.7 pct of GDP this year and, in line with fiscal commitments and the debt sustainability assumptions, this will need to rise to just over 2 pct of GDP for the next four decades.

This will be the framework that will define Greece’s own plans in the context of the new SGP discussions, where it is understood that countries will have to own medium-term plans of fiscal policy based on spending ceilings and reforms that will place debt trajectories on sustainable paths. This applies specifically to countries burdened by high debts, with Greece topping the eurozone table.

Over the last years and, especially over the last few months as Greece approaches elections, the government has used the fiscal flexibility and the availability of fiscal space from taxes outperforming, for several types of handouts and one-off benefits.

This favourable environment will not be available in the coming years as even fiscal space will not be readily available to be distributed and debt reduction initiatives could take priority.

In any case, the fiscal outlook for Greece in the coming years will be much more restrictive and fiscal policy will need to become calibrated towards fiscal order, debt reduction and more strategic objectives at EU level.