-

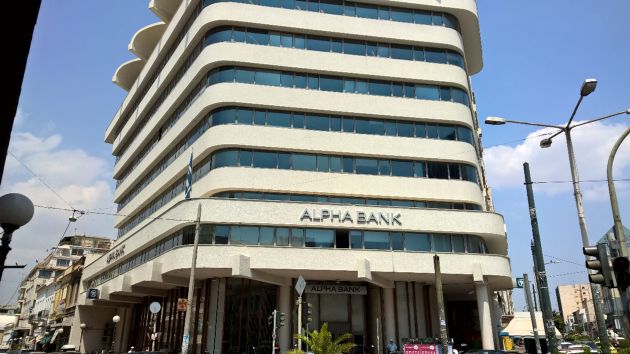

Alpha Bank net profits at 704 mln in 9M, commission income jumps 14 pct YoY

Alpha Bank net profits at 704 mln in 9M, commission income jumps 14 pct YoY

-

NBG net profit nears 1 bln up to Sep, commision income rises 7.6 pct to 336 mln

NBG net profit nears 1 bln up to Sep, commision income rises 7.6 pct to 336 mln

-

Piraeus Bank profits at 815 mln in 9M, fees income at 489 mln

Piraeus Bank profits at 815 mln in 9M, fees income at 489 mln

-

Eurobank net profits exceed 1 bln up to Sep, commissions jump 24 pct YoY to 557.2 mln

Eurobank net profits exceed 1 bln up to Sep, commissions jump 24 pct YoY to 557.2 mln

-

Alpha Bank's net profit at 517 mln in H1, commissions jump to 229.1 mln

Alpha Bank's net profit at 517 mln in H1, commissions jump to 229.1 mln

-

NBG net profits at 701 mln, commissions income rises 8 pct YoY to 221 mln

NBG net profits at 701 mln, commissions income rises 8 pct YoY to 221 mln

Piraeus and Alpha forge ahead with share capital raises and securitisations

Activity in Greece’s banking sector continues unabated as Greek systemic lenders proceed with their plans to improve their balance sheets and leave behind the legacy of the decade-long debt crisis.

Piraeus Bank was the first to tap the positive mood around Greece and the sector, through a share capital increase of 1.38 billion euros, following a three-day book-building process that priced the 1.2 billion new shares at the top of the range at 1.15 ...

Full Access

A tailor-made service for professionals

Apart from having access to all our analysis and data, subscribers will be able to consult one-on-one with our analysts.

Free Access

Read some of our analysis for no charge

By signing up to MacroPolis, readers will be able to read two of our articles without charge each month. They will not have access to our data or weekly e-newsletter.

Standard Access

Our analysis and data at your fingertips

Subscribers will be able to read the full range of our articles, access our statistics and charts, and receive our weekly e-newsletter for €530 per year.

€530.00