-

For 2026, PDMA sticks to debt strategy that proved successful previously

For 2026, PDMA sticks to debt strategy that proved successful previously

-

CPI accelerates to 2.4 pct YoY in Nov, housing costs up 3.7 pct

CPI accelerates to 2.4 pct YoY in Nov, housing costs up 3.7 pct

-

Energy leads 1.4 pct YoY drop in producer prices for Oct

Energy leads 1.4 pct YoY drop in producer prices for Oct

-

Fitch rating upgrade concludes another successful year for GGBs

Fitch rating upgrade concludes another successful year for GGBs

-

Scope leaves rating unchanged at 'BBB', ups outlook to positive

Scope leaves rating unchanged at 'BBB', ups outlook to positive

-

Low-productivity economy a legacy of adjustment without transformation

Low-productivity economy a legacy of adjustment without transformation

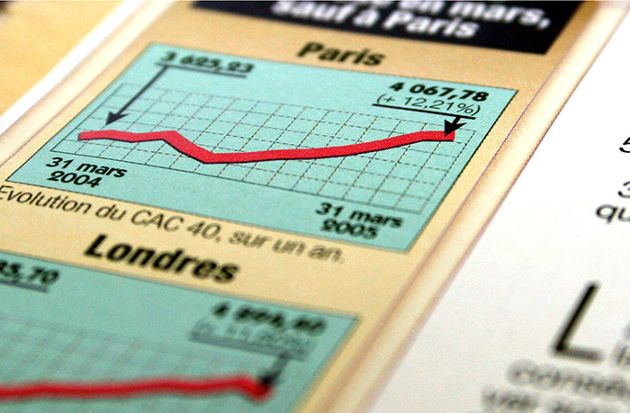

Strong rebound of 7.7 pct in week for Greek stocks with jump in trading activity

Greek shares rebounded 7.7 percent this week for the first time in the last four weeks amid a jump in trading activity triggered by the introduction of new NBG shares last Monday and indices rebalancing.

The Eurogroup Working Group (EWG) tentatively approved the disbursement of the next sub-tranche of 1 billion following the approval by the Parliament of the last multi-bill on prior actions. This mainly included legislation on the licensing and regulati...

Full Access

A tailor-made service for professionals

Apart from having access to all our analysis and data, subscribers will be able to consult one-on-one with our analysts.

Free Access

Read some of our analysis for no charge

By signing up to MacroPolis, readers will be able to read two of our articles without charge each month. They will not have access to our data or weekly e-newsletter.

Standard Access

Our analysis and data at your fingertips

Subscribers will be able to read the full range of our articles, access our statistics and charts, and receive our weekly e-newsletter for €530 per year.

€530.00