-

Another crisis chapter closes, triggering final round of debt relief measures

Another crisis chapter closes, triggering final round of debt relief measures

-

Exit from enhanced surveillance nears, but fiscal commitments bind Greece until 2060

Exit from enhanced surveillance nears, but fiscal commitments bind Greece until 2060

-

Enhanced surveillance concludes, but more reforms and tougher fiscal targets lie ahead

Enhanced surveillance concludes, but more reforms and tougher fiscal targets lie ahead

-

Some tasks, risks left as Greece takes another step to exit from post-bailout surveillance

Some tasks, risks left as Greece takes another step to exit from post-bailout surveillance

-

Latest EC review clears path towards end of enhanced surveillance process in 2022

Latest EC review clears path towards end of enhanced surveillance process in 2022

-

Creditors give thumbs up for 10th post-MoU review, underline pandemic legacy

Creditors give thumbs up for 10th post-MoU review, underline pandemic legacy

IMF sees eurozone debt relief pledges failing to deliver sustainability

![Photo via IMF photostream on Flickr [https://www.flickr.com/photos/imfphoto/] Photo via IMF photostream on Flickr [https://www.flickr.com/photos/imfphoto/]](resources/toolip/img-thumb/2014/08/11/imf_439_1108-large.jpg)

Following the executive board meeting on July 20 that approved in principle the precautionary Stand-By Arrangement (SBA) for Greece, the International Monetary Fund published its updated Debt Sustainability Analysis, which includes the relief measures that were agreed in the June 15 Eurogroup.

As it outlined in its recent Article IV for Greece, the DSA is based on the Gross Financing Needs (GFN) framework due to the majority of Greece’s debt consisting of official sector loans with favourable servicing terms. Also, the financing needs framework captures the debt burden more accurately than looking at it from the stock-of-debt point of view.

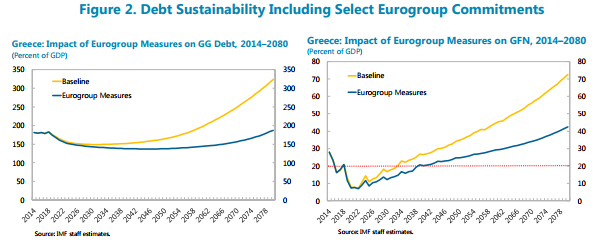

Within the GFN framework, debt sustainability can be achieved by keeping gross financing under the 15-20 percent of GDP threshold over the time horizon under consideration (until 2080 in Greece’s case) to cover the maturity of the official loans, and ensuring that the debt is on a downward trajectory.

While the Fund remains on the sidelines of Greece’s programme due to the debt issue remaining unresolved, it stresses that any debt restructuring solution must achieve the two objectives outlined earlier because solutions that provide temporary debt relief are not consistent with debt sustainability

The IMF’s baseline scenario is defined by a series of assumptions that have been supported by the Fund throughout Greece’s current ESM programme.

The primary balance is seen at 1.7 and 2.2 percent of GDP this year and next, reaching 3.5 percent in the 2019-2022 period before falling to its long-term level of 1.5 percent of GDP. The IMF expects Greece to grow close to 2 percent as the economy recovers, with real long-term growth at 1 percent and nominal at 2.8 percent.

The Fund considers the level of NPLs and the weak quality of capital of Greek banks a large contingent liability for the Greek state and sets aside a buffer of 10 billion euros (5.5 percent of 2016 GDP) to cover any additional bank support that might be required.

The estimate for revenues from asset sales and privatisations is a mere 2 billion euros up to 2030, at just 1.1 percent of last year’s GDP. The Fund argues this a realistic projection given Greece’s track record on generating privatisations revenue, combined with the depletion of state’s share to Greek banks after the latest round of capital increases to just 20 percent (from 60 percent previously). The Fund does not see any material revenues from the state’s holdings in banks.

Official interest rate projections remain the same as in the Article IV DSA, while market rates are seen at 6 percent at the end of the programme, reflecting the absence from markets, weak record of primary surpluses and the debt overhang, which translates into a 450-500 basis point risk premium.

The DSA is adjusted to include the short-term debt relief measures that were agreed in last year’s Eurogroup and the medium-term ones that were recorded at the meeting of eurozone finance ministers last month. Although the IMF finds that these commitments improve Greece’s long-term debt outlook, they do not suffice to restore debt sustainability as the stock of debt does not follow a declining path, staying in the region of approximately 150 percent of GDP before resuming an increasing trend closer to 190 percent of GDP after 2070.

In similar fashion, gross financing needs are kept below 20 percent of GDP up to 2040, before resuming an accelerating trend that exceeds 40 percent by 2080.

The Fund concludes that “to provide more credibility to the debt strategy for Greece, additional debt relief will be needed; this could include, for example, further extensions of maturity and grace periods and interest deferrals on European loans.”

IMF approves programme "in principle," repeats position on debt and reforms

IMF approves programme "in principle," repeats position on debt and reforms  IMF sets out why it stands apart from eurozone on long-term growth prospects

IMF sets out why it stands apart from eurozone on long-term growth prospects  IMF insists fiscal targets unrealistic, cites historical evidence to support case

IMF insists fiscal targets unrealistic, cites historical evidence to support case