Greece - Some structural macroeconomic arithmetic

It is fall season (2023), which means that the Ministry of Finance, the Central Bank of Greece, the European Commission, and the OECD and IMF, among others, look ahead and present their near-term outlook for the Greek economy. This blog attempts to place the messages in context by looking underneath the surface. Can we ascertain Greece’s structural underlying basis?

All macroeconomic outlooks are nested inside a temporary cyclical position that the economy happens to be in at the time that the outlook is made. For instance, when an economy has suffered an adverse shock and has had weak activity and growth, then the outlook will almost always point to a recovery of sorts. The level of economic activity is then seen as having been below its “potential” level (with high unemployment). This position is described as a “negative output gap” (realized activity is below full-employment and/or “steady state” activity).

As the economy recovers, the growth rate must mathematically be above this “potential” output growth number for the negative output gap to close (and vice versa if the economy slows from a positive output gap).

The core idea is that all economies are subject to shocks and the ups and downs of the business cycle. After weakness, the economy may be expected to speed up. After strength, it may be expected to slow down. It is the average trend over the ups and downs of the business cycle that gives us an idea of the longer term potential output growth in the economy.

With this in mind, where is Greece at this moment? The ideas of the output gap and potential output growth are intuitive, but measuring their size is not easy—they are not directly observable. This explains why different institutions have different estimates of potential output and potential output growth.

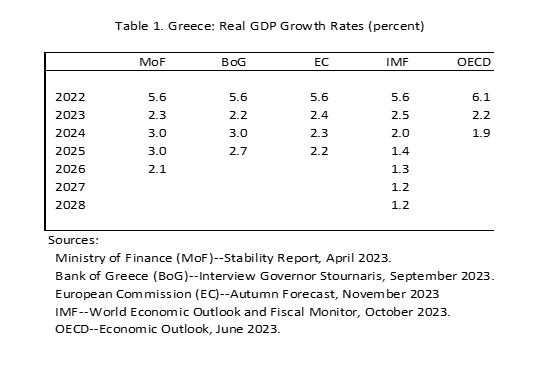

Consider Table 1 below, which presents recent growth outlooks for Greece by the Ministry of Finance, the Bank of Greece, European Commission, IMF, and OECD.

The outlook from the EC and IMF are somewhat later in the year and reflect more recent information. The authorities tend to be more optimistic in general, which may reflect optimism bias as they have skin in the game (political systems feel a need to provide an uplifting vision). But all these outlooks show slowing over time, suggesting that Greece will transition from a current rebound to more normal longer-term trends.

The IMF suggests that trend output growth sits around 1¼ percent a year. The OECD seems to be below 2 percent. This is also the impression for Greece from the European Commission in its Aging Reports, which look at structural issues related to demographics and their impact on the economy. The authorities of Greece, regrettably, do not produce long-run structural scenarios for their economy, which would require the analysis of potential output growth over time. Rather, impressions from conversations with Greek officials and economists suggests that potential output growth may hover “around 2 percent,” in their view, for the time being.

These differences in potential output growth estimates are not innocent for policy making. All policy making takes place in a distinctive psychological atmosphere of what the economy may be expected to deliver. If the growth potential is generous, then fiscal policy can be generous as well, and monetary policy can be relatively loose. The economy then has the capacity to grow out of high deficits and high-liquidity monetary settings, after all. Thinking critically through the potential capacities of an economy becomes truly important in a risk-analysis context.

Allow me to illustrate this notion in a counter example, and a counter impression. One could make the argument that all of the above potential output growth impressions are too optimistic. Why? Consider that the population of Greece is projected by demographers to be declining on trend since the onset of the recession of the 2010s. The working-age population (WAP) is declining even faster than the headline population, because within the existing population, aging is subtracting incremental working-age persons. And, Greece does not have a high participation rate even within the WAP, for cultural and policy reasons. None of these very fundamental forces is easy to reverse by government action. For now, WAP is steadily declining by around 0.3-0.4 percent a year. This means that structural labor supply (number of workers available to produce GDP) is also declining around the same rates.

Real GDP growth is the sum of two variables: how fast is labor supply (L) growing (or falling), and how fast are average workers in the economy becoming more efficient to make up for fewer in number.[1] The latter variable is described as average labor productivity (Q/L).

From historical data, we can see that average labor productivity growth has been slowing down over the decades to below 1 percent a year in the EU27 and the euro zone. It was negative for a while in Greece during the recession of the 2010s, but this was of course an unusual episode. Most countries have seen a slowing in labor productivity growth. For Greece, the underlying growth rate in average labor productivity may recover to around ¾-1 percent a year, which would constitute a catching up effect with partner countries.

We can now put together a falling supply of labor with a gradual recovery of productivity to moderate levels of productivity growth. The reader can do the math: -0.3 to -0.4 percent for labor supply growth, combined with +¾ to +1 percent for productivity growth gives a potential output growth range of 0.4 to 0.7 percent a year. Let us round this to a range between ½ to ¾ percent a year. This is much lower than any of the impressions suggested by Table 1.

How could this affect the interpretation of the current growth rebound in Greece? According to this view, there are three cycles that affect Greece at the same time: the business cycle (a few years in length), the structural cycle (1-2 decades), and the demographic cycle (40-50 years up and down respectively). Greece is currently benefiting from a cyclical rebound from Covid and a structural rebound from the deep recession in the 2010s. The demographic cycle is slowing growth, and this anchor will weigh for a while.

Still, from the first two cycles, if the 2010s felt terrible, the 2020s will feel much better, as is already manifest. Moreover, tax payers of partner EU countries have made available to Greece a total package (accrual) of 33 billion euros in loans and grants in the RRF. This is a big support at this time. And, tax payers of partner EU countries are holding Greek debt at very low interest rates through about the mid-2030s. This, too, is a big support for Greece at this time.

Greece needs to use the current favorable circumstances to prepare for the next 5-10 years into the 2030s when the support mechanisms will fade. The two rebound cycles will become neutral whereas the demographic anchor will remain. What is the appropriate calibration for policy when the underlying structural growth rate of ¾ percent a year emerges? We can give some hints at this, too.

Consider fiscal policy. Greece has signed up to the Maastricht Criteria, which include a need to work toward a debt ratio of 60 percent of GDP. The debt ratio is an asymptote defined by the average nominal fiscal deficit divided by the average nominal growth rate of the economy: D = def/GDP growth. The Maastricht Criteria reflect an average deficit of 3 percent of GDP, an average nominal growth rate of 5 percent, and thus a debt ratio of 60 percent (3/5).

But Greece cannot make an average nominal GDP growth rate of 5 percent, which would imply 2 percent inflation (ECB in charge) and 3 percent real growth. Greek real growth may be ¾ percent a year, as we saw above. With 2 percent inflation, that makes for 2¾ percent nominal growth. If the 60 percent debt ratio is to be observed eventually, then the deficit must be 0.60*2¾ = 1.65 percent of GDP, or below.

Then comes a further complication. The economy is not nice and steady, as these calculations suggest. Instead, it is constantly subject to the risk and reality of shocks. Thus, one needs margins to protect Greece from adverse dynamics and spikes in risk premia. Margins depend on one’s risk appetite. One could suggest here that Greece needs to aim for nominal overall deficits of 1 percent of GDP or less, for a while, to be on a good long-term structural track. If growth surprises on the upside, less than 1 percent would be recommended, letting automatic stabilizers compress the deficit. If shocks are adverse, the same automatic stabilizers could be employed and a somewhat higher deficit could be accepted, at least for a while.

Greece would then have a good chance to effectively achieve counter-cyclical fiscal policies. Flanking structural reform policies should then aim at making product, services, and labor markets more competitive, until Greece shows that it can achieve a current account surplus. This result would demonstrate that the underlying structural competitiveness of Greece has at last been bolstered. Greece, so far, has never had a current account surplus, not even during the depth of the recent recession—a sign that the economy is not fundamentally competitive.

Interest rates on the new debt issues in Greece have hovered around 4 percent. At the current 165 percent of GDP debt ratio, this shadow price suggests that the underlying interest bill is 4*1.65=6.6 percent of GDP. This is more than double the current size of the interest bill. It means two things: (1) it is an indication of the size of support that Greece is receiving from partner countries who hold this debt at below market interest rates; and (2) at a structural deficit objective, from above, of 1 percent of GDP, the instantaneous primary balance would need to be a surplus of 5.6 percent. This is clearly not doable. Rather, at a debt ratio of 60 percent, such an interest bill would be 4*0.60=2.4 percent of GDP. This translates into a minimum primary surplus of 1.4 percent of GDP.

Greece thus needs to transition from being close to a structural position for the primary balance of 5½ to 1½ percent of GDP. Greece currently envisages a target for the primary balance of 2 percent (just above the notional limit).[2] It would make sense to aim for 3 percent instead. Greece can then sleep more comfortably at night. Despite the feel-good stories by pro-cyclical rating agencies, Robert Frost was correct - miles to go before we sleep.

*Bob Traa is a macroeconomist and author of "The Macroeconomy of Greece: Odysseus' Plan for the Long Journey Back to Debt Sustainability" published in 2020.

[1] Q is real GDP; Q = L * (Q/L). The growth rate of Q is the sum of the growth rates of labor and productivity.

[2] The primary balance for 2023 is estimated at 1 percent, even though growth is well above potential. Fiscal policy seems too loose, at present.

Podcast - Whose property? Greece’s housing challenges

Podcast - Whose property? Greece’s housing challenges Can the Green Transition be just?

Can the Green Transition be just? Where is Greek growth coming from?

Where is Greek growth coming from? Bravo, Bank of Greece

Bravo, Bank of Greece