China-EU: Navigating an increasingly complex relationship

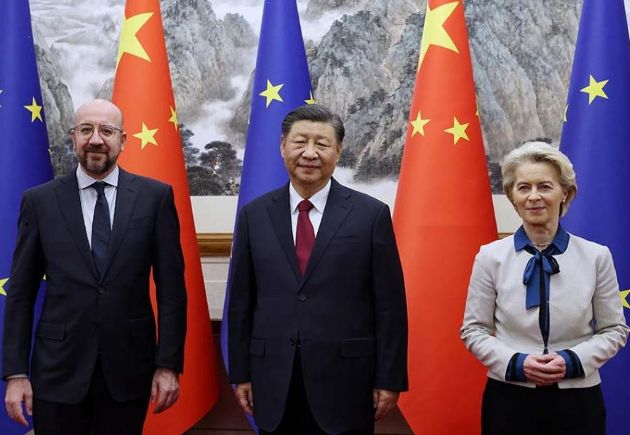

The EU-China summit in Beijing on 7-8 December 2023 took place twenty months after the previous online event, which was famously panned as a “dialogue of the deaf”. This time around, the summit was preceded by efforts on both sides towards some sort of re-engagement in the wake of pandemic-induced travel restrictions and absence of in-person meetings for more than two years.

Several European heads of state and as many EU commissioners had already visited Beijing in 2023. And, yet, the lead-up to the summit was marked by low expectations and mutual suspicion. Tellingly, it was known beforehand that a joint statement would not be agreed-upon, as no breakthrough was expected anyway.

Knives out in Beijing

China and the EU are close economic partners, trading goods worth €2.3 billion a day. However, the EU’s trade deficit rose to a whopping €400 billion last year, which shows that this relationship is heavily tilted towards China. Brussels has repeatedly raised the structural issues to be addressed, such as China’s overcapacity in steel and electric vehicles that are rapidly inundating European markets, hefty subsidies and price distortion, Beijing’s preferential treatment of domestic companies, shrinking access to the Chinese market, etc.

Charles Michel pointed out that, while “the EU-China relationship is one that matters, we need to make our trade and economic relations more balanced, reciprocal, and mutually beneficial”. Ursula Von der Leyen spoke of a “summit of choices”, a thinly veiled threat that the EU is determined to use its defensive tools, unless there is a visible change of tack on the part of China.

Nor did the EU officials shy away from reiterating deep concerns about “sensitive” topics, such as human rights violations in Xinjiang and Tibet, forced labour, and increased tensions in the Taiwan Strait. Never has the language of EU officials been so strong and even blunt in talks with their Chinese counterparts.

And never has the EU been so clear on Russia’s invasion of Ukraine, as well as on the demand that China not provide lethal weapons and dual-use equipment to Moscow’s military machine. The EU leaders once again underlined the importance of China refraining from supplying lethal weapons to Russia or circumventing sanctions on Moscow.

In turn, Chinese president Xi Jinping’s talking points came across as being bland and predictable, such as the hackneyed line that "China and the EU should be partners for mutually beneficial cooperation" and “cement the bonds of shared interest”. Arguably, his most intriguing remark was that Beijing does not consider Europe to be “anybody’s vassal”, a reference to the close transatlantic ties.

Premier Li Qiang noted China's objections to the “politicisation of economic and trade issues”, and expressed hopes that the European side would be “prudent in introducing restrictive economic and trade policies, and the use of trade remedies”. The truth is that Beijing is fuming over the EU’s de-risking strategy, the ever-growing list of defensive measures and the recently launched investigation into Chinese state aid to electric vehicle producers.

What came out of the summit?

Perhaps the summit was a deliverable in itself, at a time diplomacy is badly needed, amid two ongoing major conflicts in Ukraine and the Middle East. Otherwise, the meetings yielded a less-than-impressive list of outputs. The two sides agreed on the establishment of working groups on financial regulation, cosmetics, wines and spirits, and there was talk of the activation of a mechanism facilitating cross-border data flows.

In addition, the leaders agreed to relaunch the High-Level People-to-People Dialogue in 2024. While very few of the European concerns were heeded, the use of dialogue formats is not insignificant and there is a sense that the assertive tone of EU officials made Beijing listen more attentively than usual.

If there was one point of agreement, that relates to the ongoing crisis in the Middle East: both sides stressed the importance of protection of all civilians in Gaza, and confirmed their commitment to the two-state solution to the protracted conflict between Israel and Palestinians.

However, the success - or failure – of the sit-together in Beijing can only be gauged in the weeks and months to come. Thus, there’s still the pending question whether the EU will include a dozen or so Chinese companies in the upcoming 12th round of sanctions on Russia. Some sort of common understanding could be reached on this contentious issue, but most probably it will be a hush-hush arrangement, as Beijing doesn't want to be seen as having its arm twisted by Brussels.

On another issue that pertains to the war in Ukraine, is it realistic to expect that Beijing will exert its sway over Putin and talk him into accepting Kiev’s peace formula? This appears to be highly unlikely, for two reasons. First, because of Beijing’s genuine commitment to the “marriage of convenience” - aka “no limits partnership” – with Moscow. Second, the growing signs of western fatigue over support for Ukraine are anything but an incentive for China to reconsider its pro-Russia “neutrality”. Therefore, the EU is likely to score no points on this count.

Looking at the big picture

Zooming out of the summit, it may be worth dwelling for a moment on what is in store for the EU-China relationship. Alongside the ongoing re-engagement drive, tension between Brussels and Beijing over prickly issues will continue, for sure. And this time around it will be more walk than talk. Europe cannot see its industrial base undermined by unfair competition and appears determined to activate the set of defensive measures piling up over the past few years. China, too, has fired warning shots, with a ban on the export of some rare earths.

Yet, the yawning European trade deficit is poised to balloon even more in the years to come. Now that China is struggling with its bloated property sector, it’s shifting investment towards manufacturing. Under Trump, the US refused to accommodate China’s industrial overcapacity and growing trade surplus, and Biden has largely followed suit. This is why Europe is worried that it is turning into the biggest market for Chinese goods and technologies, but without the American military might and the global weight of the greenback.

At the same time, the EU may not be that helpless, thanks to interdependence. Europe is a key destination for Chinese exports, worth €626 billion in 2022, which accounted for 3.8% of China’s GDP. Given the weak domestic demand in the country, exports remain a key driver of the world’s second biggest economy. This explains why Beijing’s so jittery about the EU’s de-risking policy, as the Chinese leadership desperately wants to avoid a full-blown trade war. And Chinese decision-makers certainly appreciate the Eurozone as a counterweight to the global dominance of the US dollar.

But Europe’s leverage over China will only materialise if the EU proves that its growing arsenal of defensive tools constitutes a credible threat to Beijing. To this end, Europeans will have to use their toolkit consistently and uniformly, and should not dither to enlarge it, if need be. But then again, the EU will have to handle the perennial squabbles between its member states, and Beijing has definitely learned how to play Europeans against each other.

Not least of all, geopolitics has come back for good. To Beijing’s undisguised frustration, the EU will stick to China’s tripartite definition as a partner, competitor and systemic rival, with the needle inexorably inching towards the rivalry component. And both sides will have to navigate an increasingly complex relationship in an increasingly complex world order.

* Plamen Tonchev is the Head of Asia Unit, Institute of International Economic Relations, Athens, Greece

Podcast - Whose property? Greece’s housing challenges

Podcast - Whose property? Greece’s housing challenges Can the Green Transition be just?

Can the Green Transition be just? Where is Greek growth coming from?

Where is Greek growth coming from? Bravo, Bank of Greece

Bravo, Bank of Greece