This is how Greece kept its budget on track in Q1

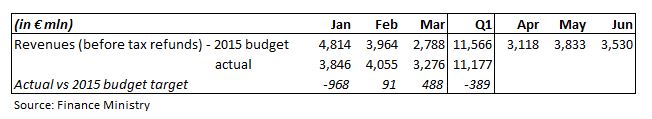

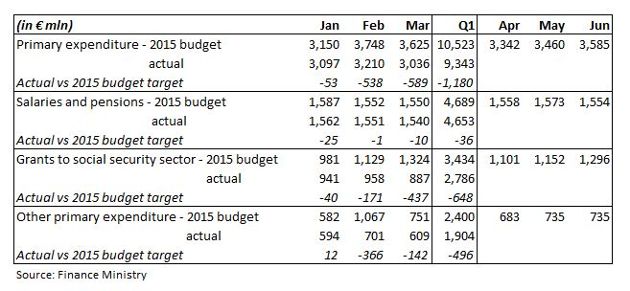

Recent Greek budget data showed the huge revenue gap of 968 million euros recorded in January narrowed to 389 million by the end of the first quarter (Q1) of 2015. At the same time, primary expenditure, which was just 53 million better than target in January, displayed a strong outperformance of 1.18 billion by the end of March.

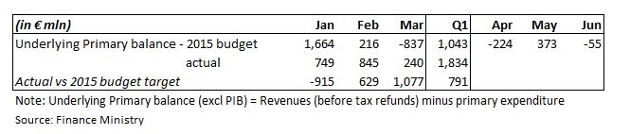

The underlying primary balance (excluding the impact of Public Investment Budget), which is defined as revenues (before tax refunds) minus primary expenditure, showed the shortfall of 915 million euros recorded in January gradually reversed to an outperformance of 791 million by the end of March.

Another important point to take away is that revenues exceeded primary expenditure in all three months of Q1, with the underlying monthly primary surplus ranging between 240 and 845 million euros. This means that the collected revenues in each month are more than adequate for the payment of primary expenses (salaries, pensions, grants to social security sector and a large part of non-payroll costs).

A closer look at the evolution of the key budget items reveals some instructive findings for the underlying trends that were recorded within Q1.

Revenues

On the revenue front, the target for January was exceptionally high as it was initially due to include VAT revenues and the fifth installment of the single property tax (ENFIA). However, the negative impact from the pre-election period as well the postponement of the VAT payment by one month had a marked impact on the revenue underperformance of that month.

VAT payments in February did not result to any significant revenue collection, with VAT revenues coming in 30 percent lower than those collected in January. However, February closed with a modest revenue outperformance of 91 million, mainly boosted by higher income tax month on month.

It is also noteworthy that actual revenues from ENFIA were very close to the targeted 2.65 billion euros, despite repeated speculation that many home owners would not pay the property tax.

In the absence of any ENFIA installment, the targeted revenues for March (2.79 billion euros) were the lowest for the first half of 2015. The actual figure came in at 3.28 billion, well below those for January and February but 488 million euros above the monthly target.

However, the marked over-performance in March is to a large extent attributed to one-off or non-recurring items. March revenues incorporated 147 million euros from the fast-track settlement of tax arrears that was implemented in the last ten days of the month. In addition it included privatization revenues of 190 million that were initially due to be reported in the first two months of the year.

April revenues are targeted at 3.12 billion. This figure also incorporates the quarterly payment of VAT. However, the actual figure will include income from two revenue sources that were not initially budgeted.

The first relates to a non-recurring item of 555.9 million euros that the state received from the Hellenic Financial Stability Fund (HFSF) on March 19 and relates to one-off fees Greek banks paid in 2012 ahead of their capital increases with HFSF becoming their dominant shareholder at that time.

Although this amount is to be reported in April’s budget revenues, it is unlikely to have any positive on the state’s current cash flow as it has probably already been utilized since it was disbursement in mid-March.

The second non-budgeted item relates to the collection of the (normal) settlement of tax arrears in up to 100 installments. According to a Finance Ministry announcement, revenues from the settlement of 2.2 billion euros in tax arrears reached 110 million in the first thirteen days of the schme.

Summing up, April revenues are expected to be boosted by 667 million euros not initially budgeted. Note though that unlike the income from the HFSF, revenues from the settlement of tax arrears should be expected to boost the amounts collected in the coming months.

Going forward, May and June revenues were initially seen at much higher levels of 3.83 and 3.53 billion respectively as they incorporated the first payments of 2015 personal income tax or ENFIA. However, it was recently announced that income tax is due to be paid as of July, while the new government has not yet clarified its stance on the ENFIA payment for this year.

The property tax may be retained for another year in its existing format due to the country’s tight fiscal position and revenue lag in Q1 but it is not clear when homeowners will start having to pay it. This means that compared to the 2015 budget targets, the actual revenues for May and June are likely to fall short of their targets.

Primary expenditure

Moving on to expenditure, the breakdown of the three key components (salaries and pensions, grants to social security sector and other primary expenditure) shows that the latter two explain the substantial outperformance of the headline figure in Q1.

Primary expenditure was beat the target by 53 million euros in January and then accelerated to an over-performance of 538 million in February and further to 589 million in March, meaning the actual quarterly figure was 1.18 billion euros better than the target.

Salaries and pensions were estimated at an average of 1.56 billion euros per month in the first half of the year, with the actual figure in Q1 coming in almost exactly on target.

Grants to the social security sector were just 40 million euros better than target in January but this was extended to 171 million in February and much higher to 437 million in March. For Q1, this specific item was 648 million better than target, making up 55 percent of the total primary expenditure outperformance.

What lies behind this performance:

1) Other healthcare expenses (covering hospital deficits) being reined in to just 43 million euros in Q1, corresponding to just 3.9 percent of the annual target of 1.12 billion.

2) Only 95 million euros, or just 6.6 percent of the annual target of 1.44 billion, going towards social protection in Q1.

In particular, allowances to families with many children amounted to 5 million in Q1 versus an annual target of 650 million euros, while grants to the Intergenerational Solidarity Fund (AKAGE) were zero in Q1 against an annual target at 454 million. Since the new government has repeatedly stressed its sensitivity on the issue of social protection, it is likely both items will return to normal levels in the second half of the year, eliminating the gap reported so far.

Other primary expenditure was just 12 million above target in January but the trend reversed in the next two months, with the actual figures coming in 366 and 142 million below their targets in February and March respectively.

Overall, the non-payroll expenses topped 1.9 billion euros in Q1 compared to a target of 2.4 billion. This 500 million made up 42 percent of the primary expenditure over-performance.

The more detailed breakdown shows that two specific expenses were contained:

1) Consumption and non-allocated expenditure, which stood at 127 million in Q1 at just 8.1 percent of the annual target of 1.57 billion.

2) Agricultural subsidies at 65 million in Q1, corresponding to 10.9 percent of the annual target of 591 million.

Unlike grants to the social security sector, it is not clear whether the cut in these particular non-payroll expenses relates to efforts to tackle excessive spending or the postponement of payments for later in the year, leading to an increase in arrears to the private sector.

*Manos Giakoumis is the head analyst at MacroPolis. You can follow him on Twitter: @ManosGiakoumis

Podcast - Whose property? Greece’s housing challenges

Podcast - Whose property? Greece’s housing challenges Can the Green Transition be just?

Can the Green Transition be just? Where is Greek growth coming from?

Where is Greek growth coming from? Bravo, Bank of Greece

Bravo, Bank of Greece