-

Podcast - Main character energy: Greece vies for leading fossil fuel role

Podcast - Main character energy: Greece vies for leading fossil fuel role

-

15% Uncertainty: Greece, Europe and the tariff shockwave

15% Uncertainty: Greece, Europe and the tariff shockwave

-

Summit of transactions – Erdogan and Trump

Summit of transactions – Erdogan and Trump

-

Podcast - DETH and taxes: The only things certain in Greek politics

Podcast - DETH and taxes: The only things certain in Greek politics

-

How will Trump's tariffs affect Greece?

How will Trump's tariffs affect Greece?

-

Podcast - Subsidise this: Fraud scandal delivers new blow to Greek PM

Podcast - Subsidise this: Fraud scandal delivers new blow to Greek PM

What Dijsselbloem didn't say

Maybe the dial in his mind was still switched to the rigours of the Dutch elections or possibly his focus was on former colleagues who might now want to challenge him for his post as Eurogroup president. Whatever the case, Jeroen Dijsselbloem exposed one of the ugliest and most damaging sides to the discussion about the eurozone since the crisis broke out in the single currency area.

“The north of the eurozone showed solidarity,” he said in an interview with Frankfurter Allgemeine Zeitung. “Solidarity is very important but those demanding it have duties too. I can't spend my money on alcohol and women then ask for help."

His comments were labelled as divisive, racist and sexist, hardly befitting a man who has an official role presiding over the regular gatherings of the eurozone finance ministers. Southern European countries felt that what Dijsselbloem said was an unfair, insulting caricature that accentuated the North/South divide in the eurozone. Even the head of the European People’s Party, the centre-right grouping in the European Parliament, Manfred Webber (often highly critical of southern European countries himself) stressed that “there is no room for stereotypes” following the Dutchman’s comments.

Calls for Dijsselbloem’s resignation came from Portugal and Italy, while the Greek government condemned his remarks as being “unhelpful.”

The Dutch finance minister, who may be out of a job in his homeland soon after his Labour Party gained only nine seats in the recent elections (a loss of 29 MPs compared to 2012), passed up the chance to apologise during a session of the European Parliament’s Economic Affairs Committee on March 21, when prompted to do so by Spanish MEP Ernest Urtasun.

“Solidarity comes with strong commitment and responsibility,” he said, insisting that he had not been referring to the south. “Otherwise, solidarity will not hold. It cannot be upheld. You will not maintain public support for solidarity if it doesn’t come with commitment and responsibility and an effort from all sides.”

Dijsselbloem later expressed regret that his original comment was misunderstood and put his comments down to “Dutch directness” and a strict Calvinistic culture. Nevertheless, he may now find it difficult to hold on to his position as Eurogroup chief – German Finance Minister Wolfgang Schaeuble, who was instrumental in Dijsselbloem getting his European position in January 2013, is the only prominent figure to have spoken in his defense.

Dijsselbloem found himself thrust into the spotlight with relatively little experience and questions about his know-how. Nevertheless, during his term at the head of the Eurogroup he has had to deal with the Cyprus bailout, a flaring up of the Greek crisis and the antics of Yanis Varoufakis, among others. This would have been extremely challenging even for more experienced colleagues. Dijsselbloem always tackled these tests with energy and calmness even if the results were not always to everyone’s satisfaction. He also appears to have made a genuine attempt to broker a decisive deal between Greece and its lenders at the December 5 gathering of eurozone finance ministers, ultimately falling short.

We should avoid our analysis of Dijsselbloem’s recent comment merging with an assessment of his time in office or him as a personality. In football parlance, we should play the ball rather than the man.

The reason for this is that the ideas the Dutch finance minister expressed are highly problematic and extremely pernicious. They tug at the strings of the latent racism that has existed within Europe since the euro crisis began and which has often been exhibited by some of the continent’s less scrupulous media, in politician’s populist rhetoric and among the popular narratives that have emerged in member states. The idea of there being a higher and lower ground in the euro area has also fueled the moralistic approach to crisis management, which has driven a wedge between the core and the periphery, while compounding rather than solving many of the problems it was meant to address.

Solidarity

There are two key issues that need to be addressed. The first is the idea of solidarity, which has been a buzzword for eurozone policymakers since the start of the crisis. The definition of solidarity is when groups or individuals act together for a common purpose. However, when European officials talk about solidarity in the context of the euro crisis, they present it as a one-way transaction: The program countries were in danger of going under but were rescued with loans provided by their partners.

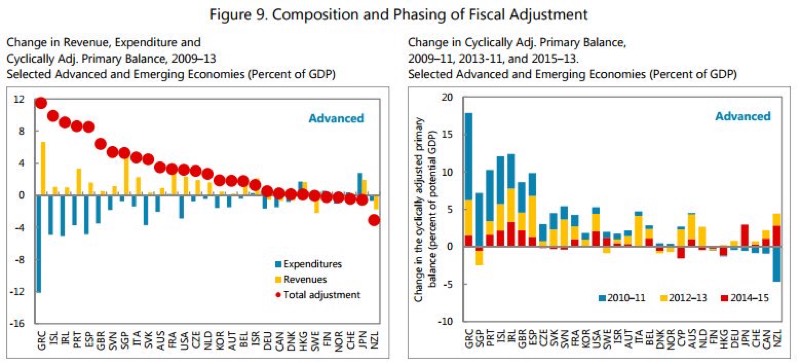

This is not false but it is a very limited interpretation of what has happened over the last few years: Members of a single currency that lacked fiscal unity and the tools to deal with a crisis ran into economic problems (for reasons we will examine shortly) and were bailed out with loans that came with strict conditionality. Although this staved off disorderly defaults and the pain they would bring, meeting the bailout conditions put a severe strain on the economies of the countries concerned. They put their public finances in order, they embarked on structural reforms and endured falls in their economic output as well as rises in unemployment levels. An idea of the level of adjustment undertaken is visible in the International Monetary Fund’s chart’s below.

As this adjustment was taking place, some of the eurozone member states providing the loans were able to shore up their defences to prevent a potentially devastating crisis dragging down their banks, which had lent freely to the bailed-out countries in previous years. The IMF described how the core insulated itself from Greek contagion in its 2013 evaluation of the first bailout.

"An upfront debt restructuring would have been better for Greece although this was not acceptable to the euro partners,” IMF staff wrote. “A delayed debt restructuring also provided a window for private creditors to reduce exposures and shift debt into official hands… this shift occurred on a significant scale and limited the bail-in of creditors when PSI eventually took place, leaving taxpayers and the official sector on the hook."

While the rest of the eurozone put up the firewall, Spain, Cyprus, Portugal and Greece felt the heat of shuttered businesses, job losses and rising emigration, especially amongst their young people.

The fact that the populist left and right has seized, or even taken hostage, the fact that the bailouts of southern eurozone countries were partly designed to protect core eurozone banks does not mean that we should ignore that this is what happened. Only if we understand the mechanics of the programmes, can we also begin to appreciate that there is more to it than some decision-makers would like to admit.

We can call this whole process an unavoidable quid pro quo or an arrangement born of necessity but let’s stop pretending it is a selfless act of solidarity. While we’re at it, we should also drop the discussion about commitment and responsibility.

The bailout programs consisted of loans, not aid, with specific conditions attached. They were not the modern-day equivalent of the Marshall Plan, even if loans were often supplied at rates that were more favourable than the what other eurozone countries could get from the markets. In the cases of Spain, Cyprus and Portugal, the terms of the programmes were met and the countries exited the bailouts. Greece is yet to reach this point but each step it makes is defined by the terms its lenders set out. Seven years on since the first bailout, there is no need to cultivate the feeling that someone is getting a free ride.

Wasteful south?

The other point that needs to be made about Dijsselbloem’s comment is in relation to the impression created (inadvertently, the Dutch politician argues) that the crisis was a result of the profligate south wasting its wealth (on wine and women, or other frivolous pursuits). Apart from the fact that this conjures up a nasty, racially-charged picture of sophisticated northerners investing their hard-earned income in productive pursuits while feckless southerners burned through their cash, it represents a complete misreading of how the eurozone worked in the build-up to the crisis. Apart from being a tone-deaf assessment culturally, it is also economically illiterate.

It is true that the onset of the crisis found Greece, Ireland, Spain, Portugal and Italy with a collective current account deficit of almost 7 percent of their GDP, suggesting that their economic priorities had gone awry. But you cannot just look at one side of the balance sheet if you want to make a proper economic assessment. While the periphery was struggling, the core, including Germany and the Netherlands, recorded a surplus of around 6 percent of their GDP. A deficit in any country requires a surplus in another to finance it.

As economists Alexandr Hobza and Stefan Zeugner point out in a 2014 European Commission paper they wrote, the euro area’s overall current account “stayed moderately positive,” never exceeding 1 percent of GDP. “The euro area current account position during its first decade thus could be called an "imbalanced balance”,” they write. “This implies that the deficits were almost exclusively financed from the surpluses in other euro area countries.”

What the eurozone witnessed in the build-up to the crisis was a “downhill” capital flow from the core, which was capital-rich thanks to excessive savings, to the periphery, which was in a hurry to catch up with its partners in the newly-created euro. The crisis brought these flows to a sudden stop.

Did the periphery invest its new-found (borrowed) wealth wisely? In many cases, it didn’t. In fact, some of it was spent on imports, from consumer goods to military hardware, from the north rather than on domestic production. Spain produced a property bubble, Greece inflated its public spending, Portugal increased consumption and Cyprus lost control of its banks.

However, to suggest that this was the only problematic part of the transactions is patently wrong. Where there is bad borrowing, there is also bad lending. The latter part, though, seems to have largely been airbrushed out of the euro crisis story. We cannot speak of unacceptable actions on the part of the borrowers and ignore the lenders, who benefited greatly from the financial integration the single currency provided but were absolved of any responsibility when their practices failed, leaving the moral hazard argument to be applied only to those who borrowed excessively but had to then pay the price for it anyway, be it through drastic fiscal consolidation in several countries, making senior bondholders in Irish banks whole or pulling the trigger on the country’s own banking system in Cyprus.

In Greece’s case, the discussion centers almost exclusively on the wasteful public spending and hardly ever on the equally reckless lending. For the record, just German and French banks had an exposure of 150 billion dollars to Greece in 2010, when it signed its first Memorandum of Understanding.

If the eurozone really wants what it learned over the last few years to help it through the next few then it has to be honest with itself and recognise the failings on the side of the lenders, who were in the core countries, and not just that on the part of the borrowers in the periphery, which have been highlighted profusely. To ignore this fundamental aspect of what led to the travails of the last few years means that eurozone policy makers are not genuinely interested in using the crisis to strengthen the single currency as a whole and each of its members individually. Instead, they are simply looking for a patsy to take the blame and act as a useful scapegoat when short-term national politics outweigh the long-term interests of educating voters about what actually happened.

It is really disheartening, shameful even, that this should be a topic of discussion in the eurozone so many years after the crisis began. Cyprus has exited its bailout after its banking system was decimated and is returning to growth, Spain is gradually overcoming the damage inflicted by its property boom, Portugal has posted its lowest budget deficit (2.1 percent of GDP) since the return of democracy to the country in 1974 and Greece stands on the verge of being able to secure a global deal with its lenders that may put the country on a path towards genuine recovery and debt sustainability. This of all years, when the European Union is celebrating its 60th anniversary, is not the time to be sowing the seeds of division. We should, instead, be looking at how the eurozone can move towards genuine convergence.

Perhaps Dijsselbloem’s words – whatever his intention – can provide an opportunity for a rebalancing to take place, for the eurozone story to be told in full and for stereotypes to be shattered. It would be powerful antidote to the emergence of neo-nationalism in Europe, which feeds off misconceptions, falsehoods and ignorance. At the very least, it would be something we could all drink to.