-

Is the Greek green transition running out of power?

Is the Greek green transition running out of power?

-

Podcast - Walking a tightrope: Greece’s geopolitical balancing act

Podcast - Walking a tightrope: Greece’s geopolitical balancing act

-

From nice story to pulped fiction: Carney delivers reality check on rules-based order

From nice story to pulped fiction: Carney delivers reality check on rules-based order

-

Record bonds, rising bills: Greece’s economic paradox

Record bonds, rising bills: Greece’s economic paradox

-

Podcast - Tax cuts and balancing acts: Greece's 2026 budget

Podcast - Tax cuts and balancing acts: Greece's 2026 budget

-

Podcast - Main character energy: Greece vies for leading fossil fuel role

Podcast - Main character energy: Greece vies for leading fossil fuel role

On monetary policy and inflation targeting

The setting. Consider two countries, A and B, that both aim to follow an inflation target, let us say 2 percent year-on-year (Y/Y) for the headline index of consumer prices (HICP).[2]

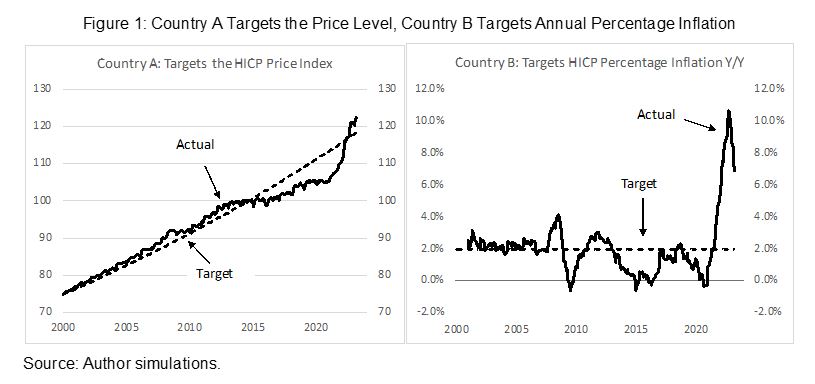

Country A has communicated to the public that it targets the price level; country B has communicated to the public that it targets the rate of inflation. We follow the record of these two countries since 2000, as shown in the twin Figure 1, below.

The dashed line in each panel shows the objective of monetary policy, aiming in both cases at a Y/Y headline rate of inflation of 2 percent. The bold line presents the actual achievement. We can see the deviations from target during the interval 2000-2023 (through Jan, using monthly data). Both countries have clearly been affected by the inflationary effects of the Ukraine War, following a period of (global) accommodating monetary policy and ample liquidity (low inflation period). All countries live in only one global economy, after all.

Country A was slightly above its target price level through 2014, followed by misses on the down side (inflation was too low to meet the price level objective) through mid 2022. The price level has recovered to above the target and there appears some momentum for further upside deviation. Consequently, the central bank in Country A has foreshadowed additional interest rate increases aiming to pinch off a bigger upside price level gap (prices are now overshooting).

Country B was close to its target rate of inflation before turbulence hit, beginning in 2008-09. Inflation has since then become unstable with swings up and down and even some touches of deflation during 2010-2021. Then, inflation jumped, reaching over 10 percent, before showing some easing toward the 2 percent objective. The central Bank in Country B announced a “data dependent” month-to-month future for monetary policy, considering “core inflation” (which strips out volatile components such as energy and food). It is hopeful that the downward trend in inflation will continue, which could allow some breathing space in the tightening schedule.

It is clear that, broadly speaking, both countries are subject to global developments—(too) soft inflation first; then a significant turnaround toward higher prices.

Public sentiment. The public in Country A sees the price level heading higher above the target; the public in Country B sees inflation coming down toward the target inflation rate. The public in country A knows that the central bank targets the price level, so it is expecting that monetary policy will continue to tighten to ease off the price level back to its target. For renewed convergence from above the price level, inflation needs to be brought down to below 2 percent, even with the risk of very low inflation for a while. Thus, because inflation needs to come down below the 2 percent rate, this raises the real interest rate in the economy (the real rate is the nominal rate deflated with expected inflation, which is falling). As a result, economic activity may slow down and unemployment may go up, until the balance between the actual and target price level has been restored.

In country B, the public knows that the central bank targets the inflation rate, which is still too high but coming down. The central bank may shift to a neutral monetary policy stance (“data dependent”) and inflation may slow further to its target—some policy ambiguity. The policy objective is to reach inflation of 2 percent, not below 2 percent. The real rate of interest in this country may stabilize, or rise only slightly (if another small i-policy step is needed) in the near future. As a result, economic activity is expected to move on for now without significant perturbations, unemployment is expected to remain little changed (apart from some lagged effects that may still be in the pipeline), and M/M, the public will see how fast the balance between the inflation target and the realized inflation rate will be restored.

The important variables influencing behavior in these two countries are the expected rate of inflation and the reaction function of the central bank in its monetary conduct setting the nominal policy interest rate. Together, these variables determine the real rate of interest that influences economic activity—its decline stimulates activity and its increase slows it.

The debate. Perhaps not known to a broad audience, there has been a debate in monetary policy circles whether central banks should target the price level, as in Country A, or price inflation, as in Country B. A key difference between these two policies is related to the treatment of “bygones.” This means that if the price level is missed on the downside, the public knows, if the central bank is credible, that it will allow inflation to rise above the medium-run target of 2 percent for some time to catch up with the price level target, but not much beyond. Thus, past inflation influences expectations about future inflation and, on average, so to speak, the rate of inflation should come out close to 2 percent to keep the price level close to target.

Thus, there is an automatic stabilizing mechanism in this price level policy: during weak activity and low inflation, the expected real interest rate will fall because future inflation will be tolerated (higher) than average (for a while) to make the price level converge to the target (from below). This stimulates activity. This inbuilt aspect of inflation level targeting is thought to be especially helpful if inflation falls to very low levels and the nominal interest rate reaches close to the lower zero bound.

The mechanism works symmetrically. If the price level reaches above the target, and the central bank is credible[3], the public knows that inflation must be brought down to below average for the price level to converge upon the target (from above). This raises the real rate of interest and activity slows down, lowering inflation without even, depending on conditions, an increase in the policy rate, or the policy rate may be raised more moderately than otherwise necessary.[4]

With inflation targeting, as in country B, the past rate of inflation is irrelevant—no crying over spilt milk. What has happened in the past is in the past and the central bank cannot undo this with any sort of monetary policy. The only relevant consideration is how to get the inflation rate back on the 2 percent target in the future (with deviations on either side of the target to be minimized).[5] This policy can introduce “drift” in the price level, with a medium-run slope in the price line that can be different from 2 percent.

If the inflation target is missed, say on the down side, then the monetary policy authorities will not seek to “make it up” with higher future inflation above the target level. Instead, monetary targeting starts every month afresh from whatever inflation rate, and price level, that was experienced in the country in the previous month.

There is no “automatic stabilizing mechanism” as with price level targeting. Expectations for future inflation are anchored at 2 percent, if the policy is credible, no matter how big the miss in the past. Thus, real interest rates are determined by the nominal policy rate and (a constant) 2 percent expected inflation. The nominal policy rate is the only instrument affecting activity, in this model, because “expected inflation,” if credible, is steady at 2 percent.

How is the debate unfolding between price level targeting versus inflation rate targeting?

· In country A there is some satisfaction that the price level has been restored successfully after a difficult period with a large negative price level gap (not unlike restoring a large negative output gap in potential real GDP analysis). The issue is now stabilisation without too much overshooting.

· In country B, the concern is that the inflation rate has been badly missed, but with some alleviation now in sight. Whether inflation expectations will hold at a moderate level around 2 percent a year still needs to be seen.

· Both countries worry about the unstable performance recently. A volatile monetary environment (or the risks of drift) inhibits investment planning, generates uncertainty for consumers, complicates wage setting, and also fiscal policy (because inflation variability generates unexpected winners and losers). Importantly, variable inflation can also destabilize the financial sector, under certain conditions, as we have seen in recent weeks. Thus, all countries prefer stable inflation.

· “Average inflation rate” targeting, that considers past inflation, is thought to be similar, if not practically the same, as price level targeting. For this to stick, however, the central bank needs to say explicitly that it is an “average inflation” targeter.

· Switching from inflation rate to price level targeting (and the inverse) can be costly in the transition, because credibility of the new targeting regime will need to be earned, and this may take some time. At the present time, almost all inflation targeters use “inflation rate” targeting, and not price level targeting (nor average inflation targeting).

· By following the fortunes of countries A and B, we may learn more whether price level targeting or inflation rate targeting is the preferred policy in practice.

Risks. One reason why price level targeting may not have been popular is the perennial question about what to do with adverse supply shocks? One cannot fix inflation caused by an adverse supply shock with monetary policy tightening lest we run the risk of (much) weaker activity. Inflation rate targeters face the same dilemma and have “solved” it by recommending to “look through the (temporary) supply shock” as long as inflation rate expectations stay anchored:

· Price level targeting must also take into consideration adverse supply shocks by modulating the vigor with which it attacks prices rising above target. Currently, small steps of a quarter point in policy rates send the unambiguous signal that prices are overshooting, which needs to be reversed, without imposing unbearable hardship on healthy economic agents (unhealthy ones should never determine policy in the first place and have to be dealt with in a different way from taking monetary policy hostage).

· So far recently, inflation expectations have remained above 2 percent, which (red) flags that these are not well aligned with convergence, from above, to the price level target.

· Core rate of inflation is much above 2 percent, indicating more pressure to come and a risk of a wage price spiral—another (big) red flag for needed convergence to target.

· Supply shocks tend to be temporary, but excess demand impulses are a political bias. This may reflect in some sense the optimism bias in political circles that notoriously overestimate potential output and potential output growth (the “adverse supply shock” is not an adverse supply shock but a normalization to realistic supply conditions in an economy pushed too hard). A credible central bank has the difficult task of “seeing through this” and keeping inflation well aligned, nonetheless.

· None of the challenges ascribed to price level targeting are different from inflation rate targeting, and the best responses are similar as well. Signs today point to a need for (gentle) further policy rate increases in both countries, whether one looks at inflation or the price level.

· Central banks will always need to have some discretion, but the sense of direction should be unambiguous. Anchoring expectations as foreshadowing policy responses is where price level targeting may have an edge over inflation rate targeting.

* * *

The bottom line is that the people in Country A are assured that the monetary authorities have at last brought the price level performance back closer to target.

The people in Country B remain anxious based on the massive miss(es) from the inflation rate target, with significant volatility and almost deflation, before the recent big bounce in inflation taking off. This was not supposed to happen. There is no telling in what direction the inflation “drift” will take the country now.

In turn, the crucial question for the readers remains: do they see merit in the alternative of price-level targeting over the current common standard inflation rate targeting (also as practiced by the ECB)? If a country experiences challenging shocks, including in the monetary sphere, could price-level targeting be a more steady anchor for the longer run for the nominal economy than inflation-rate targeting, which can generate drift in the price level? We welcome all thoughts.

* * *

Readings. For those interested in price level targeting, we append some reading suggestions. There is voluminous literature on inflation rate targeting, because that is the current standard. Some readings on price level targeting:

Bernanke, Ben: “Temporary Price Level Targeting: An Alternative Framework for Monetary Policy.” Brookings, October 12, 2017.

Minford, Patrick and Michael Hatcher: “Inflation targeting vs Price-Level targeting: a new Survey of Theory and Empirics.” CEPR, 11 May 2014.

Bohm, Jiri, Jan Filacek, Ivana Kubicova, and Romana Zamazalova: “Price Level Targeting-A Real Alternative to Inflation Targeting?” Czech Journal of Economics and Finance, 62, 2012.

Barnett, Richard and Merwan Engineer: “When is Price Level Targeting a Good Idea?” Bank of Canada, June 2000.

Svensson, Lars E. O.: “Price Level Targeting vs. Inflation Targeting: A Free Lunch?” NBER Working Paper, August 1996.

Bob Traa is an independent economist. His latest book is “The Macroeconomy of the EU27, a Work in Progress,” discussing demographic, growth, and fiscal/debt challenges in EU countries, including options for the reform of the Maastricht Criteria now underway (Amazon.com).

[2] Generic names A and B are used to prevent inadvertent influence on the readers (bias) who may be familiar with the monetary policy of specific countries, and have prior opinions on them.

[3] Central bank credibility is under attack from two sides: fiscal dominance as politicians want to be bailed out with low interest rates and monetization of the debt, and financial dominance as banks want to be bailed out with low interest rates and deposit guarantees. A higher inflation tax can lubricate both wheels, but of course, the poor will pay most of this bill. In the latest inflation bout, central banks have been behind the curve and their credibility got hit, for now.

[4] The academic literature assesses that if expectations are mainly forward looking (as specified in the Phillips Curve equation that posits a tradeoff between inflation and real activity/unemployment), then price-level targeting may be welfare improving over inflation rate targeting.

[5] The ECBs new monetary policy regime (8 July 2021, available on the ECB website), switched from an inflation rate target of “below, but close to, two percent” to “two percent over the medium term”. The ECB stresses that the target is symmetrical; i.e. deviations below and above are to be minimized. But, the ECB is not an “average” inflation targeter, and also is not a price-level targeter. The ECB targets the HICP. It is aiming to bring in a more accurate measure of housing cost, by improving the owner-occupied housing cost component in the HICP.