-

Podcast - Walking a tightrope: Greece’s geopolitical balancing act

Podcast - Walking a tightrope: Greece’s geopolitical balancing act

-

From nice story to pulped fiction: Carney delivers reality check on rules-based order

From nice story to pulped fiction: Carney delivers reality check on rules-based order

-

Record bonds, rising bills: Greece’s economic paradox

Record bonds, rising bills: Greece’s economic paradox

-

Podcast - Tax cuts and balancing acts: Greece's 2026 budget

Podcast - Tax cuts and balancing acts: Greece's 2026 budget

-

Podcast - Main character energy: Greece vies for leading fossil fuel role

Podcast - Main character energy: Greece vies for leading fossil fuel role

-

15% Uncertainty: Greece, Europe and the tariff shockwave

15% Uncertainty: Greece, Europe and the tariff shockwave

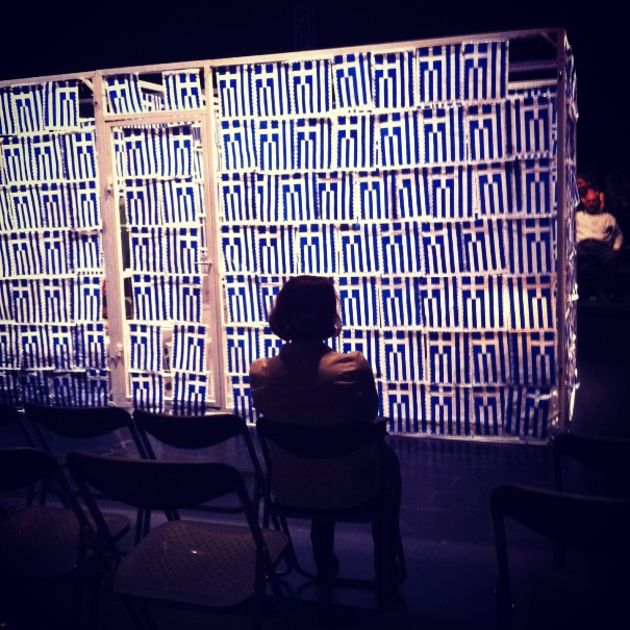

The Greeks deserved better than this

For some time it appeared that Greek Prime Minister Alexis Tsipras, or at least some of the people advising him, felt Greece had something to gain from being in a take-it-or-leave-it situation with lenders as the pressure would be on the other side. Right now, with the uncertainty of a referendum looming, perhaps it doesn’t seem such a good position to be in.

The theory that the lenders would back down at the last minute, giving Tsipras a deal that would be better than the one he could get by agreeing terms early on in his premiership, has not worked. On Wednesday the institutions (led by the International Monetary Fund) rejected more than half of nearly 8 billion euros in measures that Tsipras had proposed on Monday and replaced them with ones he had turned down a few weeks earlier.

The proposals Tsipras submitted on Monday were the latest in a series of steps that his government took to move closer to creditors’ positions in the hope of sealing a deal. The argument that Athens has not been willing to “play by the rules” or to make sacrifices in return for further bailout funding has had no basis over the last couple of months as it slowly conceded ground on a whole range of issues, albeit while trying to minimise the impact on politically sensitive areas such as pensions.

There can be an argument over the impact of the measures Tsipras proposed, which relied almost exclusively on tax rises. The IMF, and perhaps other lenders, felt that these measures would be too recessionary. At the same time, though, they had spent the previous months insisting that there is “flexibility built into the Greek programme” and that Tsipras could replace some measures with alternatives. However, the institutions repeatedly rejected Greek proposals for savings from administrative measures and the much-vaunted structural reforms that the troika implored previous governments to implement. This was the result of a serial lack of trust, built up over the last few years, SYRIZA’s amateur approach and intransigence on the other side of the table. In the end it seems the Greek prime minister was free to pick any measures he wanted, just as long as they were the lenders’ ones.

The abruptness in the way the lenders whipped away Tsipras’s last-ditch proposals, threw them in the bin and replaced them with a new document splattered with red font prompted many in Greece, including critics of the government, to wonder whether this was an attempt by lenders to bring down SYRIZA and its coalition partner Independent Greeks. The document, which tracked all the changes made, seemed an attempt to show Tsipras who is in charge. It smacked of payback for the numerous verbal pot-shots that Tsipras and Finance Minister Yanis Varoufakis have taken at lenders over the last few months, as well as the time wasted at the start of this government’s reign.

The Greek side has to take the responsibility for creating this bad blood and failing to capitalise on whatever goodwill there was when SYRIZA came to power. There is a fine line between pushing back against the lenders, which drew strong public support, and appearing obdurate, even aggressive, with the institutions and countries that are your only hope of preventing a default and potentially destructive exit from the euro. Too often SYRIZA approached its dialogue with creditors as it would a street protest, with raised voices and facile slogans. It is no surprise that the other side met its new interlocutors with scepticism and exasperation.

However, lenders cannot be left out in the process of assessing who should carry the can for the serial failure of the last few months. Too many finance ministers, leaders and unnamed “European officials” have been willing to take SYRIZA on in verbal sparring, often trying to show that they have better put-downs or even making statements that undermined the stability of the Greek banking system. On a practical level, though, the most disruptive tactic from the lenders’ side has been to systematically herd this government back towards terms that the previous coalition failed to agree to. The institutions spoke of flexibility but only showed a limited amount of it in their approach.

Apart from lowering primary surplus targets (which is offset by the return of recession since late last year) and an uneasy stand-off on labour market reform, there is not much else to show in terms of concessions. And, for whatever compromises have been made, the lenders have come back with new and politically suicidal demands such as increasing VAT on hotels to 23 percent.

Underpinning all this, though, is the denial from the European side to consider any debt relief, which would not only ease the economic pressure on Greece but also provide Greeks with a clear target to work towards. The refusal to consider debt sustainability is also a refusal to consider political and social sustainability.

The deal that is currently on the table would mean substantial pension cuts and tax hikes, on top of what has been implemented over the last few years. This is not only very far from what SYRIZA pledged before the January elections, it is also some distance from what voters thought was realistic to expect from this government. SYRIZA may have cultivated false hopes during its election campaign but not all its voters expected it to be able to implement most of them. The truth is that a lot of Greeks were just fed up with New Democracy and PASOK and the diet of austerity measures they had served up since 2010, without being able to make people feel that the country was turning the corner,

If Tsipras brought back the lenders' proposals, it is unlikely his government would survive. A new round of austerity and political instability would have been the best Greeks could have hoped to come out of their near-impossible situation. Now, Tsipras has thrown the question back to voters by calling for a referendum. It could be seen as a moment of catharsis, to put to bed once and forever any illusions about the terms of staying in the euro. It could also be seen as a reckless move, coming at the end of fraught negotiations and with the extension to Greece's programme running out before the plebiscite takes place.

What's certain, though, is that it is yet another moment during this crisis when decision-makers (both Greek and European) have shifted the burden caused by their own failings to the Greek people, who have put up with the economic collapse and tough fiscal measures over the last few years but deserved much better – from all sides.

*Follow Nick on Twitter: @NickMalkoutzis

18 Comment(s)

-

Posted by:

What EU and IMF are proposing is only a short term solution. And if you take their solution, will create more burden from already stressed Greek people. In fact if these external people have been "friends" of Greece, there would be better options proposed by them. No - they are not your friends. I suggest and urge Greeks people stand together and face the situation and create internal robust solutions. Greeks are tough people - hard working, honest and caring. And they will come out strong with or without EU. Some of the measures that Greeks can take up and boost the economy - identify your internal resources, price your exports higher, mine your natural resources, increase your working hours by 2 hrs extra every day, over produce goods, reduce wastage of precious energy-water etc, reduce wastage of anything, tax multinationals, avoid goods from across the border- manufacture your own, reduce corruption. And last but not the least - Ask your diaspora to support you and send more money home. And rally together. You will become a strong country in 5-10 years. Good luck. GOD is with you

-

Posted by:

Maybe they will be able to print a new currency with same value than the euro. Or USA could allow Greece to use US Dollar, as they do in Africa at least for one country.

Maybe they have such skills in finance and global Law that they will all of a sudden tax ancient Greek frauders.

To propose anti-constitutional referendum for the week after smells amateurism, ain't it? -

Posted by:

A debt is a debt.

Are Greek able to recover taxes from their billionaires?

Are they willing to tax ship industry?

It is sad but pensions should be inquired.

23% hotel tax was a very good idea: many people would have travelled to Greece in order to participate. -

Posted by:

Follow the money. Before the bailout about 60 percent of Greek debt was held by Greek banks and individuals. Now the debt is overwhelming held by EU institutions, primarily Germany and France. Only 11 percent is held privately. Eighty-nine percent of the bailout funds go to the bailout lenders. The EU bailed-out Greece to protect its own banks, but it placed a burden on the Greek government that could never be met.

Count the money. There is no way Greece could ever repay the bailout. Today's drama is just a closing chapter in the drama of EU stupidity in managing the Euro.-

Posted by:

This is only part of it. Default would mean a great benefit to Greece because the following debt would be wiped out immediately:

Sovereign debt 350 Bil. euros

ELA support to Greek banks never to be repaid: 120 Bil. euros.(about 90 Bil. current plus miscellaneous).

Total benefit: 470 Billion euros.

-

-

Posted by:

wow . I think your boxers are in a bunch. Tsipras has gone up to bat tenfold ..He stepped into a sh÷t storm from the previous government. ..kind of like Obama did...grexit all the way to your freedom .I can't wait to vacation in greece.Thrir beaches are the most beautiful in the world.

-

Posted by:

Imho Greece has got what it deserves:

The result of a tricky approach to participate in Euroland combined with the effects of resisting to all those reforms that intelligent actors would have implemented since then.-

Posted by:

https://www.youtube.com/watch?v=KP50QzPAlFY

-

-

Posted by:

Greece will leave the Euro...this is what they deserve. This is the only option left and Greeks decided their fate all on their own. Tsipras speaks of humiliation by the rest of Europe? Greeks should be ashamed of themselves for believing in a fairytale government ...how naive? Like the saying goes, ' what comes around goes around ' . Spending other people's money and not paying them back.? Thieves! You will get what you deserve..and don't let the door hit you on your way out!

-

Posted by:

You're an idiot and what you deserve will come to you and your family too. Don't judge without knowing being in someone's shoes

-

Posted by:

You can do beetter than this!!! try again you fool,

-

Posted by:

You seem like a very angry person. Perhaps ease up on the coffee and get your facts straight. Did a Greek sell you a used car that was a lemon at some point in your life? Try breathing exercises.

-

Posted by:

https://www.youtube.com/watch?v=KP50QzPAlFY

-

-

Posted by:

Greece has already won this not yet completed pseudo-negotiation. Everybody knows it already regardless of degree of sophistication.

Therefore what we are left to assess is the degree of the victory which is not quantifiable yet.

Berlin has embarrassed itself and has allowed a novice like Tsipras to run circles around it.

This is a huge victory for Tsipras any which way you cut it.

It might also mean a new radical phase in Greek politics where all the remnants of the old dysfunctional political cronies are swept away in favor of the emergence of new faces better equipped and unburdened from the sins of collaboration with the enemy.-

Posted by:

The benefits of default are great because in addition to 350 Billion euros of sovereign debt we would also be wiping out roughly 120 Billion of addition ELA _ miscellaneous support given to Greece. Therefore the total benefits package to Greece would be 0.5 Trillion euros.

I warned you at the beginning that you have to be intelligent to win a negotiation and unfortunately your compatriots are anything but. -

Posted by:

No doubt, future PM Plassaras will do it by telling all Greeks something like: "Yes we can".

And then, his likened House of cards will fall apiece...

But without gallows humor:

Now you will have the chance to see if any other country is prepared to pay the same amount of money for Greece that Germany has spent and will loose by Grexit.

-

-

Posted by:

This has been a dreadful negotiation. Whether it is the fault of the Greek government or of the troika does not really matter.

The proposed VAT on hotels of 23% is particularly bizarre. In Greek circumstances this a tax on exports. The VAT rates around Europe on hotels are almost all at the concessionary rate, for example Croatia 13%, Cyprus 9%, France 10%, Italy 10%, Germany 7%, Netherlands 6%, Portugal 6%.

It is economically illiterate to promote better competitiveness (through internal devaluation) and a high tax on exports. -

Posted by:

Why the Greeks deserved beter than this is essentially left unanswered in this article.

The elementary truth is that one should not spend what is not earned. This is where the Greeks fail.

And it needs to come to a halt very soon.